FAQS REGARDING EXECUTIVE ORDERS 2-2020 AND 3-2020 PROVIDING MEASURES TO LIMIT FORECLOSURES

WHAT IS THE DURATION OF TIME THAT THE LIMITATION ON FORECLOSURES IS IN EFFECT?

Executive Order 2-2021 states:

- All directives issued pursuant to EO 2-2020 and EO 3-2020 continue to remain in force insofar as they do not conflict with the January 13, 2021, Directive regarding public gatherings, businesses, schools, and masks.

- 2. All government-issued regulations that rely on EO 2-2020 and EO 3-2020 remain in effect pursuant to EO 2-2021.

Exceptions are:

- For individuals who are members of a vulnerable population, who have suffered a significant financial hardship as a result of the outbreak, and who, pursuant to this Directive, remain sheltered at home, the protections of the March 30 and April 13 Directives continue and will expire 30 days after the individual ceases to shelter at home or at the end of the emergency, whichever is sooner.

- "Vulnerable Individuals" is defined as people over 65 years of age, people with serious underlying health conditions, including high blood pressure, chronic lung disease, diabetes, obesity, or asthma, and people whose immune system is compromised such as by chemotherapy for cancer or other conditions requiring such therapy.

WHAT TYPES OF RESIDENTIAL REAL PROPERTY ARE COVERED UNDER THE LIMITATION ON FORECLOSURES?

Residential real property means a residential structure or mobile home which contains one to four family housing units, or individual units of condominiums or cooperatives.

ARE OCCUPIED RESIDENTIAL PROPERTIES CURRENTLY USED AS RENTALS COVERED WITHIN THE LIMITATION ON FORECLOSURES?

Yes. It is the Division's position that residential properties currently being used as rentals are included within the context of residential real property as defined within this Directive, as long as the rental contains one to four family housing units and is currently occupied.

IS THERE AN EXEMPTION TO THE PROHIBITION ON FORECLOSURES FOR VACATED OR ABANDONED PROPERTIES OR IS THE MORATORIUM APPLICABLE TO ALL FORECLOSURES?

Yes. The directive excludes foreclosures in which the grantor, mortgagor, or other debtor (including family members) is no longer in possession and no longer occupies the residential property personally as their primary home.

IS IT PERMISSIBLE FOR LATE FEES TO BE CHARGED ON TRUST INDENTURES OR MORTGAGES OF MONTANA RESIDENTIAL REAL PROPERTY?

No. Late fees are not permitted to be charged or collected on trust indentures or mortgages of Montana residential real property while the Executive Order is in effect.

HOW SHOULD BANKS, CREDIT UNIONS, AND RESIDENTIAL MORTGAGE SERVICERS HANDLE CONTRACTUALLY REQUIRED REPORTING TO THE CREDIT BUREAUS FOR LOANS COVERED UNDER THE LIMITATION ON FORECLOSURES?

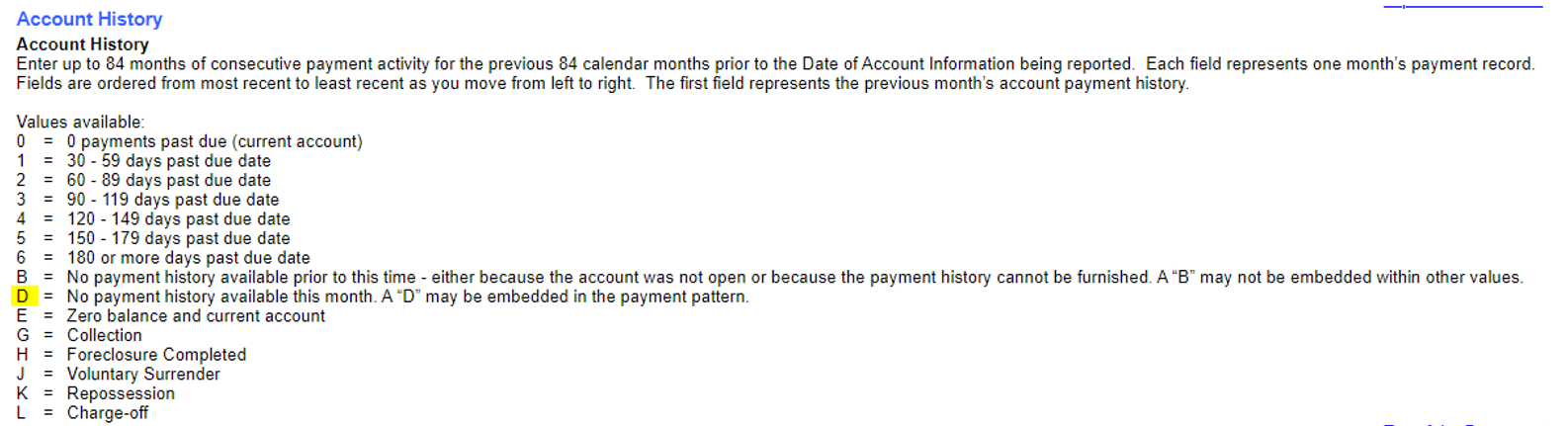

According to Experian, banks, credit unions, or non-depository residential mortgage servicers can report a "D" in the account history grid for any applicable foreclosures that are subject to the Directive. The "D" means no payment history is available for this month. A "D" may be embedded in the payment pattern.

*Equifax and TransUnion have not responded to inquiry, but it appears there are similar codes that can be applied for reporting to those bureaus.